|

The

Insurance Game

10.22.15

-- $8,447.

That’s what I’m paying for home, car and health

insurance this year. And I've got no choice.

You need insurance to register a car, you need it for your home if you

have a

mortgage, and you need it for healthcare because it’s

the law.

Hurricane Wilma aftermath

|

But when Hurricane Wilma damaged my roof in 2005, it

took four years and arbitration for the state-run

“insurer of last resort,” Citizens

to finally pay up. My car insurer, Geico, just raised my rates 10

percent for no

apparent

reason, seeing how I haven’t had a claim in 30 years.

And with healthcare, you wind up paying for insurance and

then paying for the service, too. My

wife Nora

went to an ophthalmologist

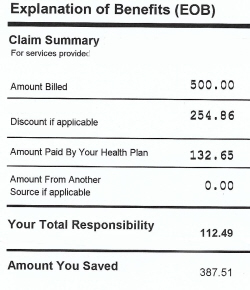

recently after experiencing floaters in her eyes. The doc charged $500

to run

two tests and tell her it was a harmless part of aging. A Blue Cross

provider strong-armed

him into offering a $254.86 discount and

Such a deal!

|

paid off $132.65 of

it,

sticking us with

the other $112.49. Then they had the audacity to proclaim on the

statement: “You

saved $387.51.”

Truth

is, there is no insurance in life. Anything can happen to anyone at any

time. You can't safeguard what you have. It could all be gone tomorrow,

with or without insurance. The industry taps into our fears, stacking

the odds to convince us to bet against ourselves. But all we're buying

is a false sense of security. Life simply isn't

designed to be insured. It's designed to be a trial-and-error process,

a series of peaks and valleys that fashion the strongest, most

adaptable individual possible. The best

insurance, I believe, is taking good care of your body. That's

why I eat sensibly, exercise regularly and do whatever else it takes to

avoid dealing with insurance companies. But it still costs me $8,447 a

year!

|